TO THE SHAREHOLDERS, ASSOCIATES AND CUSTOMERS OF RPM:

Last year we began to introduce the tagline “Building a Better World” in some of our communications,

including the annual report. On one hand, it represents our products and services, which literally

contribute to making structures better through beautification, protection, restoration and sustainability.

At the same time, it is meant to be aspirational as we strive to make the world a better place for those

we serve, including our customers, entrepreneurs, associates, shareholders and the communities in

which we operate.

Move the clock forward to today, and this tagline seems rather prophetic. A year ago, nobody would have predicted

that we would be in the middle of a global pandemic that has produced an economic recession. Nor would we have

anticipated worldwide outcries for equality, justice and social change during this already uncertain time. Now, more

than ever, it is important that we come together and strive to make the world a better place for everyone. In the pages

of this annual report and at 2020ar.rpminc.com, the online supplement to this report, you can learn about some of the

many things our 14,600 associates are doing around the globe to build a better world for all.

"Our team’s laser focus both on top-line growth and operational excellence has built terrific momentum and enabled us to outpace the earnings growth of our competitors. This was particularly evident through the first nine months of the fiscal year, before the pandemic and resulting recession took root. At that time, our sales were up 2.1%, while our diluted earnings per share (EPS) increased 50.0%, which is an extraordinary yield."

Frank C. Sullivan, Chairman and CEO

FISCAL 2020 GROWTH INITIATIVES

We started our 2020 fiscal year on June 1, 2019, by building a better RPM with a realigned operating structure. We shifted from three operating segments to four—Construction Products Group, Performance Coatings Group, Consumer Group and Specialty Products Group. This change enabled us to improve synergies and better manage our assets. At the same time, it provides investors with greater visibility into the business and better comparability among our peers. During the year, we stayed focused on growth, launching a multitude of new, innovative products. Among them were DAP’s Tank Bond adhesives line, Euclid Chemical’s Level Top PC-AGG self-leveling concrete overlayment, and a portable disinfectant sprayer jointly developed by FinishWorks and Kop-Coat. We also maintained our commitment to research and development, allowing us to continue creating new problem-solving innovations for our customers. One example is Carboline’s new Fire-Science Research Center, which opened in February and enhances our position in the global fire protection market.

In addition, we added several new businesses to the RPM family. Tremco’s acquisition of Schul International, a manufacturer of commercial joint sealants, expanded Tremco’s impregnated foam tape technologies. In December, our Mantrose-Haeuser business acquired Profile Food Ingredients, which makes food stabilizers and emulsifiers, enabling us to broaden our reach in the food industry.

Through March, these many initiatives had us trending toward another year of record sales that would have surpassed last year’s figure of $5.56 billion.

MAP TO GROWTH GENERATES EXTRAORDINARY BOTTOM-LINE RESULTS

Last year, I passed the reins of our MAP to Growth operating improvement program to Michael H. Sullivan, our vice president of operations and chief restructuring officer. Our team’s laser focus both on top-line growth and operational excellence has built terrific momentum and enabled us to outpace the earnings growth of our competitors. This was particularly evident through the first nine months of the fiscal year, before the pandemic and resulting recession took root. At that time, our sales were up 2.1%, while our diluted earnings per share (EPS) increased 50.0%, which is an extraordinary yield.

As part of the MAP to Growth program, our MS-168 manufacturing system, which focuses on continuous improvement, continued to be implemented at our plants around the world, allowing us to produce better products more quickly, cost effectively and sustainably. Our efforts to centralize procurement provided greater control over our supply chain, enabling us to obtain certain raw materials at better price points. We also made great strides in streamlining our administrative functions and consolidating our many IT platforms. Additionally, we have closed 22 out of the 31 plants that were originally targeted for consolidation at the start of the MAP to Growth program. We remain on track to reach our targeted $290 million in annualized savings over the course of the program.

DECISIVE ACTIONS TAKEN IN RESPONSE TO COVID-19

In March, when we had to pivot from business as usual to address the Covid-19 crisis, we took decisive actions to restrict travel, limit access to our facilities, establish new safety protocols, and allow those who could effectively perform their jobs remotely to do so. Many of these initiatives were enacted well before governments established stay‑at‑home orders.

These actions slowed some MAP to Growth initiatives, particularly manufacturing improvements and ERP consolidations. In addition to these delays, sales growth has been lower than originally forecasted due to the economic slowdown and dampened acquisition activity, which has extended the timeline to achieve our original objectives. While there is still too much uncertainty at this point to set a new target date, plenty of opportunities remain available for self‑improvement as we look forward.

At the same time, we harnessed our entrepreneurial spirit to find new ways to sell, manufacture and distribute our products; provide our services; respond to customer needs and collaborate with one another. We also provided support to our local communities, all while keeping ourselves, our colleagues and our families safe and healthy. I am especially appreciative and proud of the incredible resilience our associates have demonstrated through all of these challenges.

RESTRUCTURING DRIVES STRONG FISCAL 2020 FINANCIAL RESULTS

The impact of Covid-19 was quick and dramatic on our businesses in the Construction Products Group, Performance Coatings Group and Specialty Products Group. For the fourth quarter, they experienced sales and earnings declines that, quite candidly, were at rates I had never experienced during my 30-year career at RPM. The silver lining in all of this was exceptionally strong demand in the U.S. for our Consumer Group’s small-project paints, caulks and sealants. Consumers had additional time for home improvement, maintenance and repair projects because of stay-at-home orders across the country. They were able to purchase the products they needed through e-commerce channels, as well as DIY home improvement retailers and hardware stores, which were among the businesses that were considered “essential” to the economy and were able to remain open and operational. The performance of our Consumer segment relative to our other segments highlights the value of our diverse operating company portfolio, where weakness in one segment is often offset by strength in another.

Despite the pressure on our top line that was created by Covid-19, our MAP to Growth program generated excellent leverage to our bottom line for the full year of fiscal 2020. Net sales were $5.51 billion compared to $5.56 billion during fiscal 2019. Organic sales declined 0.8%, while acquisitions added 1.1%. Foreign currency translation reduced sales by 1.3%. Net income attributable to RPM International Inc. stockholders was $304.4 million, an increase of 14.2% compared to $266.6 million in fiscal 2019. Diluted EPS increased 16.4% to $2.34 versus $2.01 a year ago. Income before taxes (IBT) was $407.8 million compared to $339.8 million reported in fiscal 2019. Earnings before interest and taxes (EBIT) were $499.0 million, an increase of 13.0% versus the $441.5 million reported last year.

Fiscal 2020 and 2019 EBIT included restructuring and other charges of $121.3 million and $126.0 million, respectively. Excluding the charges in both years, our adjusted EBIT was up 9.3% to $620.3 million compared to adjusted EBIT of $567.5 million during the year-ago period. Investments resulted in a net after-tax gain of $1.1 million during fiscal 2020 and an after-tax loss of $7.7 million during the same period last year. Excluding the restructuring and other charges, as well as investment gains and losses, our adjusted diluted EPS increased 13.3% to $3.07 compared to $2.71 in fiscal 2019.

CASH FLOW AND FINANCIAL POSITION

As a result of the economic uncertainty created by the pandemic, we have focused on generating strong cash flow and maintaining liquidity. At year end, we reported record operating cash flow of $549.9 million as a result of good working capital management and center-led procurement initiatives. Our procurement team, formed as part of MAP to Growth, has done an incredible job of improving payables by negotiating better terms with our suppliers. At May 31, 2020, our total liquidity, including cash and committed revolving credit facilities, was $1.28 billion.

As part of our MAP to Growth program, we established the goal of repurchasing $1.0 billion of our stock. We have exceeded the halfway point of that goal by repurchasing approximately $325 million of our common shares in fiscal 2019 and 2020, coupled with the $205 million cash redemption of our convertible notes in November 2018. While we were making good progress on this goal, given recent macroeconomic uncertainty resulting from the Covid-19 pandemic, we have suspended our share buyback program.

GENERATING VALUE FOR SHAREHOLDERS

In October 2019, our board of directors increased our cash dividend by 2.9% to $1.44 on an annualized basis. This was the 46th consecutive year we have increased our dividend to shareholders, a record only a handful of other publicly traded companies can match. Increasing our dividend each year is one way we reward our long-term shareholders. The benefit of this practice is reflected in our total shareholder return, made up of share price appreciation and reinvested dividends, which has outpaced the S&P 500 by 44% and our peers by 19% over the past 10 years.

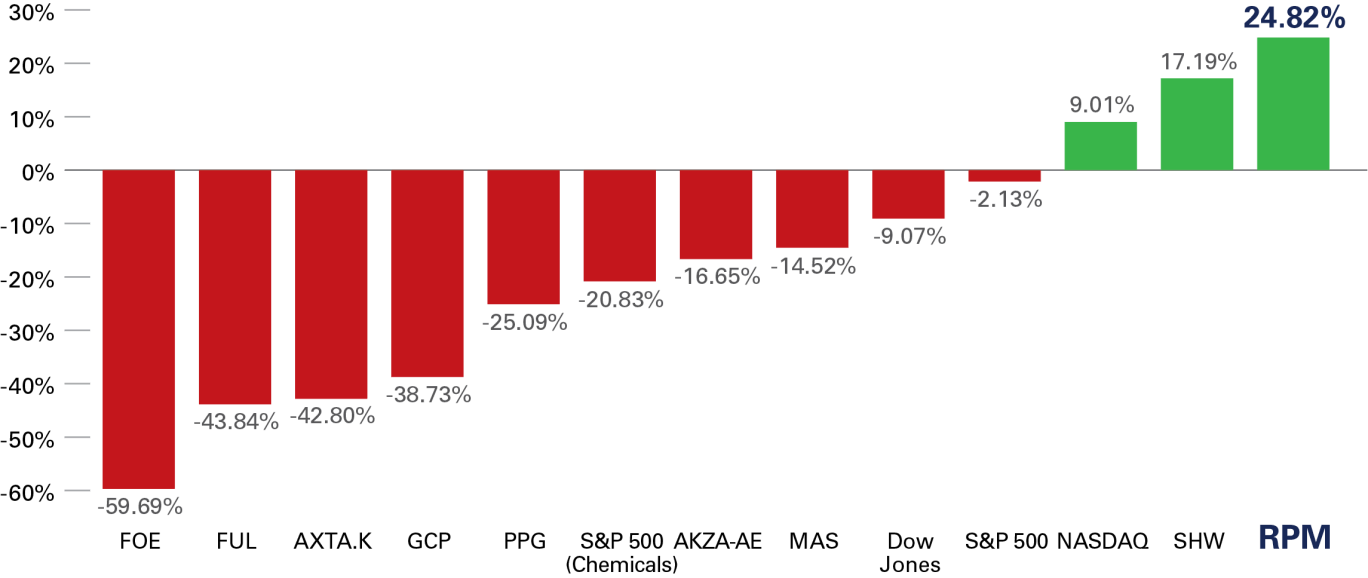

We have also performed well over the near term. During the two-year period ended March 31, 2020, which spans from the beginning of our MAP to Growth program and concludes just as the pandemic began, our stock price increased nearly 25%. Over the same timeframe, our peers declined 28%, on average, and the S&P 500 declined more than 2%.

FISCAL 2021 OUTLOOK

In the early part of our fiscal 2021 first quarter, our consolidated sales began to trend better, indicating that sales declines resulting from the pandemic may have bottomed out in April and May. Although economic conditions remain uncertain, today our outlook for the first quarter compared to the prior-year period is for net sales growth in the low single digits and adjusted EBIT growth of 20% or more.

For the full year of fiscal 2021, we anticipate that our Construction Products Group and Performance Coatings Group could experience sales declines for the first three quarters and then turn positive in the fourth quarter. Our Consumer Group should continue its strong sales momentum into fiscal 2021. The Specialty Products Group is expected to face negative sales comparisons during the first two quarters, which should turn positive in the back half of the year. These projections assume that we do not experience a second wave of lockdowns related to Covid-19. Due to the continued economic uncertainty around the length and severity of the pandemic, we are not providing earnings guidance for the full year of fiscal 2021 at this time.

OUR FOCUS FOR FISCAL 2021

While the pandemic continues, we remain focused on managing the aspects of the business that we can control in fiscal 2021. We will continue to be aggressive in reducing costs and improving cash flow to drive performance and further advance our MAP to Growth program. It has proven very beneficial in driving efficiency and making us even more competitive. We will continue to develop innovative new products. We will maintain our entrepreneurial culture, which is one of our core strengths. Through it, we remain nimble to adjust to market conditions, which is especially important in this uncertain and volatile environment. We will be focused on cash flow, selective in acquisition activity, maintain a preference for debt reduction in lieu of share repurchases, and intend to continue our track record of increasing our cash dividend for a 47th consecutive year.

Looking ahead to our 2021 fiscal year, I am cautiously optimistic. We opened the year with positive momentum in our business. This momentum is carrying us through the pandemic and has us well positioned to continue our accelerated pace of growth as global markets reopen and economic activity resumes.

I would like to thank our associates around the world for continuing to grow our business, while executing our operating improvement plan and navigating the challenges of the pandemic. I also extend my gratitude to our customers for their continuing business and partnership, particularly during these uncertain times. Finally, I would like to thank our shareholders for their ongoing trust and investment in RPM.

Very truly yours,

Frank C. Sullivan

Chairman and Chief Executive Officer

August 26, 2020